Retirement Calculator - Paychex

Civilian Federal Retirement: Current Law, Recent Changes, and Reform Proposals - EveryCRSReport.com

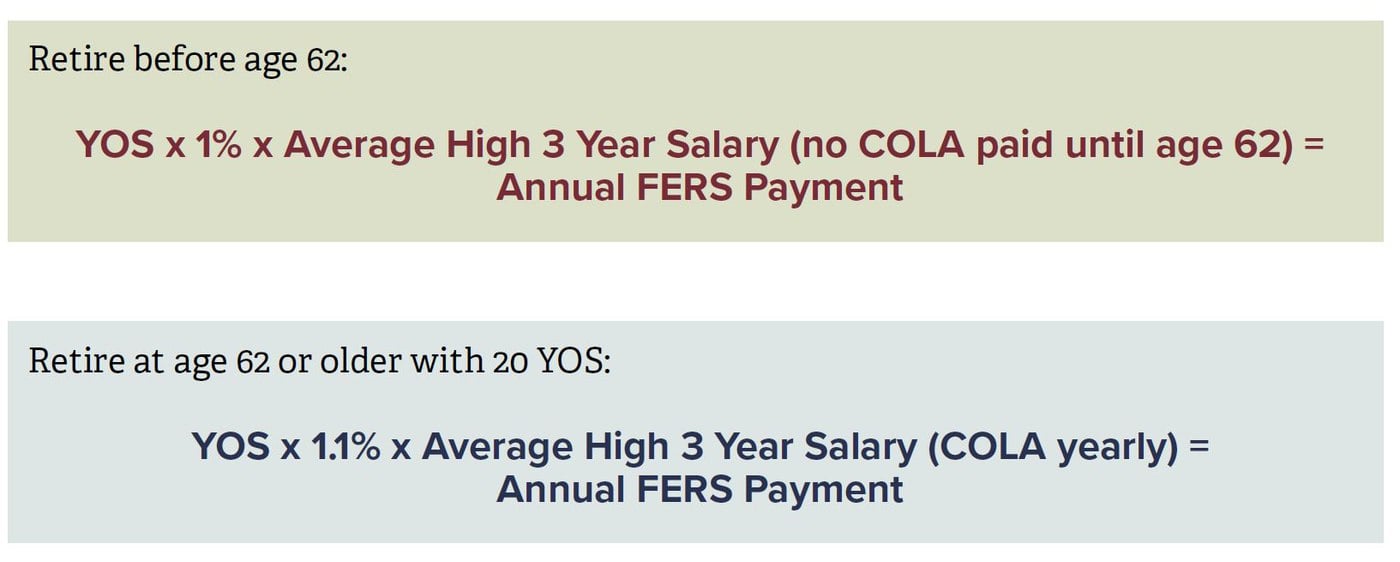

Indicators on Retirement - An Official Air Force Benefits Website You Need To Know

This supplement estimates the Social Security advantage made while utilized by the federal government. Research It Here are offered to those employees who retire: after their MRA with 30 years of service; at age 60 with 20 years of service; upon early voluntary retirement (age 50 with 20 years of service or at any age with 25 years; if a company is going through a major reorganization, reduction-in-force (RIF) or transfer of function the supplement begins at the MRA and continues up until age 62); and upon uncontrolled retirement, starting at the MRA till age 62.

: FERS senior citizens who have revenues from earnings or self-employment may have their Special Retirement Supplement minimized or dropped in the Social Security profits test (see Social Security).

CSRS & FERS Retirement Calculator - Federal Government Retirement Calculator

This is a combination of the extra information boxes (Pop, Up boxes) available in the Federal Ballpark E$ timate and the assumptions used in the estimations. A B C D E F G H I J K L M N O P Q R S T U V W X Y Z Annuity Rate Of Interest for TSP and non-TSP A Thrift Cost savings Plan (TSP) annuity supplies income in the form of monthly payments for as long as you - and your joint annuitant, if you elect an annuity with survivor advantages - are alive.

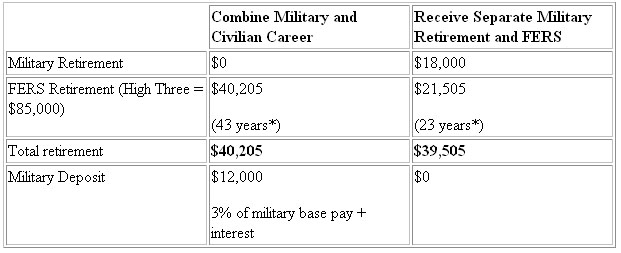

Military Service Credit Deposit - Buy Back Military Time

The elements that impact the quantity of the regular monthly payments consist of: The annuity choice you select Your age when your annuity is bought (and the age of your partner or other joint annuitant) The balance in the TSP account utilized to buy your annuity The "rates of interest index" when your annuity is acquired For purposes of the Federal Ballpark E$ timate, we will provide an approximated annuity based upon Single Life, increasing (inflation protection).